EPF balance check has become essential for 7+ crore salaried employees in India tracking their retirement corpus. With EPFO’s digital upgrades in 2025, checking your EPF passbook, balance, contributions, and interest is now possible in under 2 minutes using UAN portal, UMANG app, missed call, or SMS, no paperwork or employer visits needed.

This comprehensive guide covers UAN activation, KYC completion, all 5 official methods to check EPF, troubleshooting common errors, withdrawal processes, and pro tips for maximum returns on your ₹15 lakh+ lifetime EPF savings.

Why Check EPF Balance Regularly? (The Big Picture)

Your EPF account grows through:

- Employee contribution: 12% of basic salary + DA

- Employer contribution: 12% (3.67% to Pension, 8.33% to EPF)

- Interest: 8.25% p.a. (2025 rate, compounded monthly)

Example: ₹20,000 monthly basic salary = ₹2,400/month contribution each → ₹57,600/year + ₹4,750 interest = ₹62,350 annual growth.

Regular checks help:

- Verify employer contributions (missing credits = lost money)

- Track interest credits (April each year)

- Plan withdrawals/loans (₹50,000+ TDS rules)

- Merge multiple accounts (job changes)

- File ITR (Form 16, 16A accuracy)

Prerequisites: Activate UAN & Complete e-KYC (Mandatory First Step)

Universal Account Number (UAN) is your lifetime EPF ID. Without activation + KYC, no passbook, withdrawals, or transfers possible.

Step-by-Step UAN Activation (5 Minutes)

You can now easily Activate your UAN through Aadhaar-based Face Authentication (FAT) on the UMANG App.

To proceed:

- Download the UMANG App from the Google Play Store or Apple App Store.

- Select EPFO Services.

- Choose “UAN Activation” under “UAN Services Through Face Auth” and follow the instructions.

For assistance, contact:

- 📞 14470 (EPFO Helpdesk)

- 📞 1800 11 4000 (UMANG Helpline)

- 📞 1915 (UMANG Helpline)

KYC Documents Required

| Document | Mandatory | Purpose |

|---|---|---|

| Aadhaar | Yes | e-KYC, Paperless claims |

| PAN | Yes (>₹50K withdrawal) | TDS compliance |

| Bank (Aadhaar-seeded) | Yes | Claim settlements |

| Photo + Signature | Yes | Digital verification |

Status Check: Login → Dashboard → “KYC Status” (should show “Approved”).

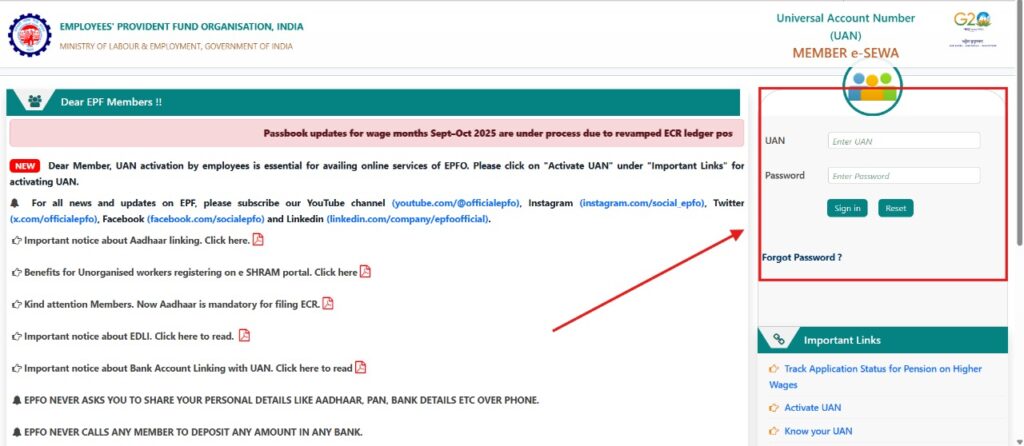

Method 1: EPFO Member Portal (Most Detailed Passbook)

Best for: Full transaction history, multiple accounts, downloads.

1. Go to unifiedportal-mem.epfindia.gov.in/memberinterface

2. Login: UAN + Password + Captcha

3. Dashboard → “View Passbook”

4. Select Member ID (if multiple employers)

5. Latest passbook PDF opens (shows: Opening Balance → Wages → Employee Share → Employer Share → Interest → Closing Balance)

6. Download for records

Timeline Note: September salary credits appear by November (20-30 day ECR lag).

Method 2: UMANG App (Mobile-First, Fastest)

Best for: Android/iOS users, instant access, offline claims.

1. Download UMANG (Play Store/App Store)

2. Register: Mobile OTP or Aadhaar Face Auth

3. Search “EPFO” → “View Passbook” OR “One Member One EPF Account”

4. Enter UAN → Mobile OTP verification

5. View: Balance, Passbook, Claim Status, KYC Updates

UMANG Advantages: No browser issues, biometric login, supports 12 languages.

Method 3: Missed Call Service (Zero Data)

Best for: No internet, quick snapshot.

📞 Dial 9966044425 (Toll-Free)

✅ Auto hang-up → SMS with latest balance

Works: 10 AM – 7 PM, registered mobile only.

Method 4: SMS Service (Regional Languages)

Format: EPFOHO UAN Language_Code to 7738299899

Example: EPFOHO 100345678912 ENG → “Your EPF balance is ₹2,45,670”

Method 5: EPFO iOS/Android App (Official)

1. Download “EPFO” app (official)

2. Login with UAN/Password

3. Dashboard shows real-time balance + passbook

EPF Balance Check WITHOUT UAN (Limited Access)

Troubleshooting: Top 10 EPF Check Issues (2025 Fixes)

| Error | Cause | Fix |

|---|---|---|

| “Invalid UAN” | Typo/Wrong number | Verify Claim ID on payslip or employer HR |

| Passbook Blank | KYC Pending | Complete Aadhaar/PAN/Bank under “Manage” |

| No Updates | ECR Delay | Wait 20 days post-month end |

| “Login Failed” | Wrong Password | “Forgot Password” → OTP reset |

| Multiple Accounts | Job Changes | UMANG “One Member One EPF” auto-merges |

| Zero Balance | Transfer Pending | Check “Service History” tab |

| TDS Deducted | Early Withdrawal | File ITR for refund (Section 192B) |

EPF Withdrawals After Balance Check (Paperless Claims)

Verified KYC = Instant approval (no employer sign):

| Purpose | Form | Max Limit |

|---|---|---|

| Full Final | Form 19 | 100% |

| Medical | Form 31 | 75% |

| Home Loan | Form 31 | 90% |

| Marriage | Form 31 | 50% |

| 2 Months Salary | Form 31 | Advance |

Online Process:

1. Check balance (above methods)

2. UAN Portal → “Online Services” → Claim (31/19)

3. Auto-fill → OTP verify → Claim submitted

4. Funds in 10-20 days (Aadhaar bank)

TDS Rules 2025: >₹50,000 before 5 years service = 10% TDS.

Advanced EPF Tools & Alerts (2025 Features)

- EPF Interest Calculator: epfindia.gov.in → Calculators

- SMS Alerts: Activate via UAN portal notifications

- API Access: Developers (UAN-based balance API)

- NPS Transfer: Seamless EPF → NPS (Form 13)

EPF Tax Planning & Maximum Returns

Tax-Free Withdrawal Conditions:

- 5+ years service

- Age 58+ retirement

- Full & Final (unemployment >2 months)

Vesting Rules: 10 years service = 100% employer share.

Regional EPFO Contacts (Complaints)

| State | Helpline |

|---|---|

| Delhi | 011-26177582 |

| Mumbai | 022-27570735 |

| Chennai | 044-22518097 |

| All India | 1800-118-005 |

Quick Action Checklist:

- Activate UAN + KYC

- Check balance monthly

- Verify employer contributions

- Plan withdrawals smartly

- Download passbook yearly for ITR

Stay Updated: Follow @socialepfo Twitter + EPFO app notifications for rate changes, new features.

Disclaimer: Always use official EPFO links. Beware phishing sites asking for UAN/password via email/SMS.

Your EPF is your retirement millionaire-maker, check it monthly, contribute maximum, withdraw smartly!